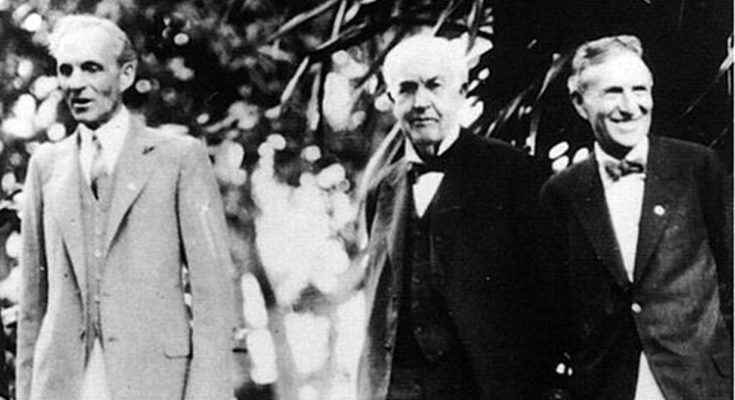

This photograph shows, from left, Henry Ford, Thomas Alva Edison, and Harvey Samuel Firestone – the fathers of modernity – meeting together Feb. 11, 1929. Photo c/o Herbert Hoover Library. Public Domain. Wiki Commons. Used with permission.

Column By Natalie Pace

Dear Natalie, Should I invest in Ford and General Electric? I’m retired and would like the income. My financial advisor tells me that both companies are bargains right now. Signed, Dividend Lover.

Dear Natalie, Should I invest in Ford and General Electric? I’m retired and would like the income. My financial advisor tells me that both companies are bargains right now. Signed, Dividend Lover.

Dear Income Lover,

Ford and General Electric are in different industries, however, the companies have more in common than you might think. Both are over a century old and have one or more problems in their business, including losing revenue or market share, cash negative operations, very high debt to equity ratios and being very behind on their pension and other post-employment benefit obligations (OPEBs). They fall into the category I call Faded Blue Chips. GE lost almost $6 billion last year, and in August of 2018, the Tesla Model 3 became the top-selling car in the U.S. (by revenue). Tesla was the only American car company in the top 5.

Perhaps the most important thing to know about these dividend stocks is that the higher the dividend, the higher the risk. Even when the markets were roaring up up up, the issues facing General Electric and Ford Motor Company caused their stock to sink. You might remember that Warren Buffett famously sold all of his General Electric stock in 2017, just a few months before GE cut their dividend in half. This prompted investors to dump the stock en masse. The share price lost more than half, too. So, even if you don’t know much about evaluating a company, if you are being offered a dividend of more than 3%, that’s a red flag.

There are a few more problems with owning individual companies in your nest egg. The first is that owning one company means you are taking on much higher risk. If you had owned GE stock in 2017, you lost half your investment, and half of your dividend income as well. If you owned a fund that had GE stock in it, alongside 100 other companies, then you’re probably still fat and happy in market returns. Another issue is that financial advisors charge you to trade individual companies (and funds, too). So, owning a lot of individual stocks will cost you a lot in fees.

Below are a few questions to ask yourself before you invest in any individual stock.

Checklist for Investing in Very Old Legacy Brands

Consider The Company’s Potential.

Consider the Industry’s Potential.

Factor in Debt, Pensions and Other Post Employment Benefits.

What’s the Dividend?

Factor in What the General Marketplace Is Likely To Do.

Are You Willing to Risk Your Principal for a Very Small Dividend?

Gone are the days that you buy a Blue Chip and hold it to will it to your grandchildren. The Wall Street rollercoaster today is nothing like the days of yore. Individual companies require babysitting in today’s world of wild market swings. And in the 10th year of a bull market, every stock can be vulnerable. So, having a defensive strategy is far more important than getting more in the game. And owning a fund with a lot of companies in it protects you from the volatility of owning just one stock.

We all love income. However, I wouldn’t be a dividend lover in a world where the mantra should be, “The higher the dividend, the higher the risk.” Roy Rogers said it best, when he wrote, “I’m more concerned with the return of my money than the return on my money.”

If you’re not sure about any one of these things that I’ve outlined, then your next investment should be in learning how to invest!

If you wish to read more about the Checklist for Investing in Legacy Brands from this Natalie Pace blog, click here.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace’s great, great grandfathers James Pace and Lorenzo Wright were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching, and 3-day Financial Empowerment Retreats.