Column By Mike Bibb

The following letter was recently sent to my legislative district’s Congressional members explaining total dismay at how much my life insurance renewal premiums were scheduled to increase.

Sept. 22, 2022

Dear Sen. Semina, Sen. Kelly, and Rep. O’Halleran,

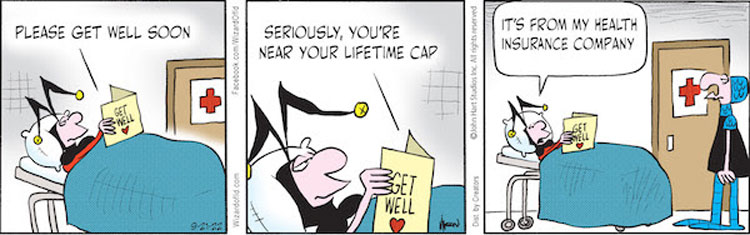

How appropriate and timely the cartoon is to the theme of my correspondence.

It appears from the newly announced monthly premium increases on my life insurance renewal notice that I’ve officially entered the Golden Years.

It took 75 years to do it, but according to the Symetra Life Insurance Company of Bellevue, Washington, my arrival into this elite stage of life comes at a hefty price if I wish to maintain my association with their organization.

Honestly, after 20 years of agreed-upon monthly premiums, I was expecting a reasonable price hike if I was to continue doing business with them. I’m not naive enough to ignore the cost of everything has substantially gone up, including life insurance.

However, I was totally amazed to discover the price of continuing my policy would be jacked up by a staggering 2,270%!!!

Not certain why, since I’m not on life-support or swallowing a variety of doctor-prescribed pharmaceuticals.

The monthly premium rocketed from $115.41 to an unbelievable $2,619.44

At first glance, I assumed the new charges to be an annual rate. Even then, it would be almost double what I have been paying.

To make certain I was reading the notice correctly, I visited my local insurance representative to get his opinion.

He was as much aghast as I. So, together, we called the company to confirm if the new rate was correct, or had some kind of accounting error occurred.

The company spokesperson verified the stated quote was the new monthly charge, and it would automatically be deducted from my banking account next month (Oct.), which has been the custom for the past couple of decades.

This means my annual insurance charges rose from $1,384.92 to $31,433.28 – about 23 times more than I had been paying.

Considerably exceeding my yearly SSI income.

When the company agent was asked what was the reason for such an astronomical price increase, he informed us it was because of my age.

Weird. One day I’m paying $115.41 per month, the next day it zooms to $2,619.44 per month for the same exact policy. Just because I’m 24 hours older?

Now, I’m certainly no life insurance guru, but common business sense would seem to suggest it would probably be more actuarially advantageous for everyone concerned if a modest premium increase was offered to a longtime customer, rather than frightening him away with outlandish new charges.

Unfortunately, that presently doesn’t seem to be the case. Actually, it appears more like A Wizard Of Id scenario – “Thanks for your prior loyalty, Mr. Bibb, but now you’re too old to bother with unless you’re willing to fork over enormous premiums. Have a nice day, and call us again if we can help with your insurance needs.”

Just thought I’d bring this matter to your attention. Perhaps, you’re already aware of what’s going on in the senior citizen life insurance world and are currently investigating the situation.

I sincerely doubt I’m alone in this predicament.

Regards,

Mike Bibb

Safford, AZ

The opinions expressed in this editorial are those of the author.