Contributed Photo: National Bank of Arizona in Safford

Contributed Article

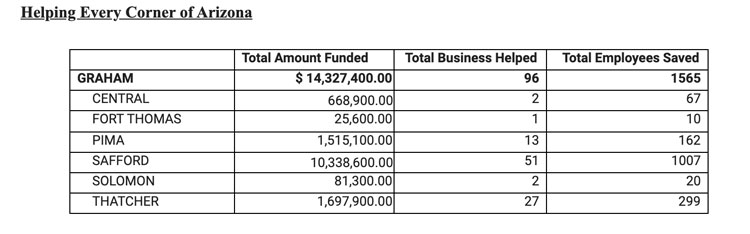

PHOENIX – National Bank of Arizona has announced today that it has helped 96 businesses in Graham County obtain $14,327,400 in funding through the Paycheck Protection Program (PPP). This funding helped save 1,565 jobs from the far-reaching impacts of COVID-19.

“The Paycheck Protection Program provided tremendous assistance to many businesses and families in Graham County,” said Mark Young, CEO and president of National Bank of Arizona. “With the presence of local branches and employees, we were able to provide access to the Small Business Administration’s PPP for Graham County businesses.”

“It has been frequently said that we are all in this together, and I certainly want to thank our customers for having the confidence to trust us to help them, and our associates for the great skill and effort they exhibited in this time crisis,” Young continued.

National Bank of Arizona was able to help small businesses in nearly 170 cities and municipalities across Arizona, from as far south as Yuma and Nogales, to as far north as Page and Kayenta. Ultimately, this funding helped protect paychecks for over 60,000 Arizona workers, based on applicant data.

While other larger banks prioritized only the largest PPP loans in favor of larger fees, more than 72% of National Bank of Arizona loans approved were for amounts less than $100,000, and more than 70% of all loans were made to businesses with 10 employees or fewer.

A recent class-action lawsuit brought about by small-business owners alleges that JPMorgan Chase, Wells Fargo, Bank of America, and U.S. Bank prioritized larger loans. According to the filing, which was made in the U.S. District Court for the Central District of California, each bank “concealed from the public that it was reshuffling the PPP applications it received and prioritizing the applications that would make the bank the most money.”

Since its beginnings in 1984, National Bank of Arizona has taken a personalized approach to banking. “When a client needs to speak to someone, we are ready to answer the call,” Young said. “This is a distinct difference in how we provide value to customers, with exceptional engagement through our 56-branch network, skilled bankers, digital platform, and customer care centers.”

About National Bank of Arizona

Specializing in forming one-on-one relationships and providing superb customer service, National Bank of Arizona offers a broad suite of products and services for individuals and businesses—from consumers to executive and private banking clients and from small businesses to corporate and commercial clients.

Taking a big picture view of each client’s needs, National Bank of Arizona provides tailored financial solutions. Clients are supported with access to executive management and local decision-making, all while NB|AZ® bankers contribute valuable financial knowledge and play a strategic role in helping clients realize their dreams.

Since its founding in Tucson in 1984, NB|AZ has expanded to play a significant role in numerous communities across the state. Backed by the strength of Zions Bancorporation, customers get the resources they need with the responsiveness and personalized service they expect from a local bank. For more information, please visit NBAZ.com.

National Bank of Arizona, A division of Zions Bancorporation, N.A. Member FDIC.