Editors note: This is a new feature where our readers can submit their investing or economic questions to author and investment guru Natalie Pace.

Dear Natalie: I recently graduated college and started my first job. Though I live on the opposite side of the country and have proven myself as an adult, my parents still nag me to put a little bit of money away each week for my retirement. I want to go to Europe! I want great shoes and great clothes, and, finally, to eat something other than my college diet of happy hour buffalo wings and Top Ramen! Why should I start saving now, at 22, for my retirement?

Dear Natalie: I recently graduated college and started my first job. Though I live on the opposite side of the country and have proven myself as an adult, my parents still nag me to put a little bit of money away each week for my retirement. I want to go to Europe! I want great shoes and great clothes, and, finally, to eat something other than my college diet of happy hour buffalo wings and Top Ramen! Why should I start saving now, at 22, for my retirement?

Signed – I want a rich life now!

Dear I want a rich life now!: You can have it all – and sooner – if you contribute to a 401K or IRA. The reason is that you’ll not be adding another bill to your budget. You’ll just be paying less to the taxman. And, if you’re healthy and you set up a Health Savings Account, you could even fund a vacation with your health insurance premium savings. When you get smart about money, you can stop making everyone else rich at your own expense and start living a richer life.

One other math equation that you should know is that if you put 10 percent of your income into tax-protected retirement accounts, and that earns a 10 percent gain, then you’ll have more money in your accounts than you earn within 7.5 years, and your money will earn more than you do within 25 years! This really adds rocket fuel to your adventures – helping in all kinds of ways. That money could be used as a down payment on your first home (which will save you thousands on taxes). Having more assets means that you might even be able to negotiate a better interest rate on everything from cars to student loan debt. You can save thousands annually with smarter choices, earn money while you sleep, enjoy a gourmet dinner and travel to Europe.

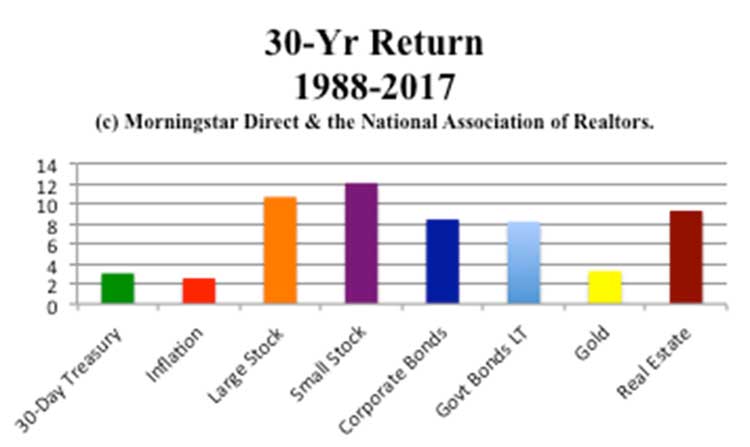

FYI: You don’t have to be a genius to earn a 10 percent gain in your 40, K, IRA and HSA. That’s what stocks and bonds have done on average for the last 30 years! (See the chart below.)

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above more than 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for more than three years (in its vertical). Natalie Pace’s great, great grandfathers James Pace and Lorenzo Wright were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching and 3-day ABCs of Money Retreats.