U.S. News ranks Arizona as the #10 state in terms of taxation, with relatively low tax burdens, and the #32 best location in the country. The state’s economy ranks #10 and #12 in its business environment. There are many reasons to believe Arizona holds a solid financial position and is a perfect environment that enables business growth and economic development. For these reasons and more, there is a lot of curiosity about the favorability of this state in taxes and accommodation, especially for budding professionals weighing their settlement options. If you fall into this category of people, you should read this article until the end. Here, we’ll discuss all there is to know about Arizona’s financial positioning, federal taxes, and what makes it an ideal location for anyone looking to build a career in the United States.

Arizona’s Economic Status and Finances

Arizona is the sixth largest state in the United States physically and is famed for its weather and geography, but this is not all there is to know about this location. An overview of Arizona on U.S. News reveals that the state currently holds $508 billion in GBP, with a median income rate of $42,346 and a #32 overall ranking in economic, education, and fiscal stability categories. According to IBISWorld, businesses in the state employed over 3.5 million people in 2023, and a rising annual employment rate of 2.0%. Furthermore, data on 2023’s per capita personal income shows that it occupies the #34 position amongst the 50 states in the country.

Although the job growth slowed down in 2023, compared to 2022, reports still revealed that the rate in the state outpaced the national average. By October 2023, the state added 51,000 jobs on the market, reaching a 1.6% increase over the previous year. The employment rate in the state also took a positive turn, increasing ever slightly from 3.8% to 4.2% in October 2023. Economic factors like inflation and annual income also took a good turn in 2023. Inflation reduced from 13.3% in 2022 to 8% in October, according to Arizona’s 3rd quarter report. The economic positioning suggested continued increase and development in moderation, and the outlook for 2024 is relatively positive.

Arizona’s Sources of Income

The state’s government generates income through various sources, such as tax revenues, federal funding, investments, and licenses, to keep the system running. While most state governments rely heavily on taxation for citizens as a major revenue source, Arizona has been listed as one of those with the most considerate taxation practices.

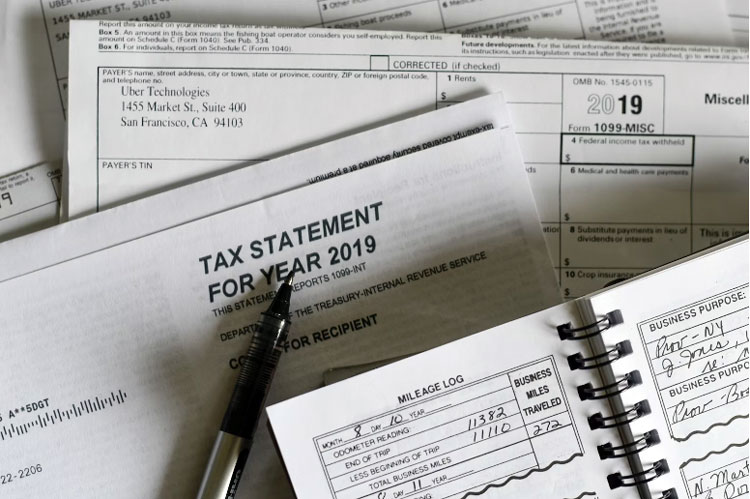

Taxation in Arizona

Taxes are the primary source of income for the government, and the categories here include individual income, corporate income, sales tax, and property tax. The state has a flat 2.5% individual income tax, a 4.90 corporate income rate, a 5.6% state sales tax rate, and a maximum local sales rate of 5.3%. Arizona is ranked 10th in low tax burden in all categories amongst the 50 states in the United States. Businesses are required to pay corporate income tax. Retail professionals in the forex market must also pay tax on the profits from forex trading.

Federal Funding

Like many other states, Arizona receives funding from the federal government. The system gets grants, subsidies, allocations, and initiatives from different categories in different sectors. Federal funding constitutes a significant portion of the state’s budget and can also occasionally help support citizens. It helps the government reduce tax burdens on its citizens while working to build better economic positioning.

Return on Investment

The Arizona government’s treasury office has stated that investing in the state’s public fund is one of its top priorities. According to data on the treasury’s official website, over $30.4 billion under its direct management. Money obtained through the state and local governments is entrusted to the treasurer as a state investment officer, after which the funds are invested in huge quality fixed-income and equity products. They monitor the assets and ensure that the state gets a good return on its investment. Revenue generated from these activities is returned to the state’s funds and used to finance other government operations.

Leveraging Arizona’s Economy and Tax Climate

Taxes can make or break your earnings, and this is one reason most people are drawn to states and locations where they are required to pay less of these fees. From the data and facts provided in this article, it’s easy to tell that Arizona is one of those locations with friendly tax weather for businesses and individuals alike. Although the economy has faced some challenges in recent years, we’ve seen slight recoveries in 2023 that point to a more positive outlook and trajectory. If you’re looking for an environment that will enable you to start a career or build a business, Arizona could be an ideal location.