Photo by Alexander Migl: Tesla Model 3 at Geneva Motorshow 2018.

On August 7, Tesla’s stock soared on a great earnings report, followed by a Tweet from Elon Musk reading that he was considering taking the company private at $420 a share. There were many 420 jokes that circulated, casting a shadow of doubt on the veracity of the Tweet, before Elon followed up his Tweet with an internal email that outlined his rationale and confirmed that the funding had already been secured. On August 9, Tesla was trading at $350/share, offering a return on investment of 20% if the proposed LBO (Leveraged Buy Out) is ultimately approved by shareholders and goes through. Musk is also proposing that existing shareholders could stay invested when the company goes private, potentially offering an even bigger upside. So, should you take Musk’s bait?

Six things to consider before buying into Tesla pre-LBO

1. The Rationale

2. The Potential

3. The Marketplace

4. The Competition

5. Other Tesla Products

6. Do You Have the Stomach for it?

And here are additional details on each point.

1. The Rationale

Why take Tesla private in the first place? According to Musk, “Basically, I’m trying to accomplish an outcome where Tesla can operate at its best, free from as much distraction and short-term thinking as possible, and where there is as little change for all of our investors, including all of our employees, as possible,” Musk wrote in his internal memo. SpaceX, another company that Elon is the CEO of, has become a leading, privately owned, space launch and exploration company in the U.S. Musk promises investors who stick with the company through the LBO a chance to liquidate once or twice a year.

2. The Potential

Electric vehicle sales are increasing by leaps and bounds over gas guzzlers. In July 2018, the Tesla Model 3 became the #1 vehicle in its class, outselling the closest premium sedan (the Lexus IS) by a factor of 3. Tesla’s year over year sales growth was 47% in the 2nd quarter of 2018, compared to flat sales at General Motors and Ford and single-digit growth at Toyota.

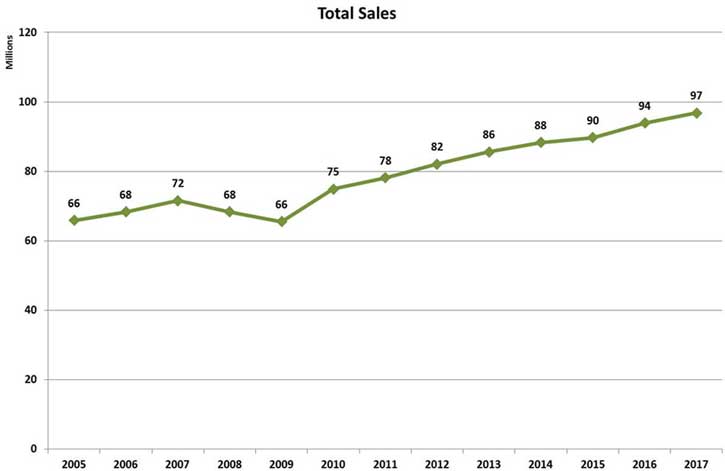

There were 97 million vehicles sold worldwide in 2017, according to the International Organization of Motor Vehicle Manufacturers (OICA.net). Tesla’s is currently producing 7,000 vehicles a week (350,000/year). The next major expansion is in China. According to Tesla’s 2nd Quarter 2018 update, “Initial capacity is expected to be roughly 250,000 vehicles and battery packs per year, and will grow to 500,000, with the first cars expected to roll off the production line in about three years.”

There is definitely competition in the EV space, with the Nissan Leaf, the Mitsubishi MiEV and more. However, Tesla broke the book on safety and performance. The Tesla S sedan earned the highest safety rating ever, and when the Roadster was first introduced it quite famously beat a Porsche – at a time when most electric vehicles drove like golf carts.

Every carmaker has plans for a luxury sedan and SUV EV. However, ramping up production and rolling out infrastructure to recharge the vehicle can take 5-7 years, at which point one can imagine an innovative company like Tesla will already be building the first EV that flies to the moon.

5. Other Tesla Products

Tesla is rapidly becoming a vertically integrated company, with an energy storage division and an innovative solar roof design. Tesla’s goal is to triple the energy storage deployments in 2018 over last year and to market the benefits of an integrated solar/storage solution to existing Tesla vehicle owners through their app to drive growth in solar power generation going forward.

6. Do You Have the Stomach for it?

6. Do You Have the Stomach for it?

Investing in individual companies is a bit like playing tennis with Roger Federer. You have to know how to compete, otherwise, the profits will just whiz by you. The market is moving to electric vehicles and Tesla is the clear winner. However, in the twilight of the bull market, even great companies can have their share price and value impacted negatively. So, when investing in any individual company, you need to understand the macro concerns and have an exit strategy that makes sense in bull and bear markets.

Tesla is now the most valuable car company in the U.S., with a market capitalization of $61.45 billion, and the sexiest growth curves in the world. That’s an attractive proposition, so your opportunity to get in at today’s closing price of $352.45 might be limited to the first few hours of trading tomorrow.

If you wish to continue reading more of Natalie Pace’s blog or to access links to the data, click here.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace’s great, great grandfathers, James Pace and Lorenzo Wright, were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching, and 3-day Financial Empowerment Retreats.