Editorial By Natalie Pace

Dear Natalie. I heard that Russia was dumping U.S. T-Bills and hoarding gold. Is this true? Signed Lost a Lot on Gold Since 2012.

Dear Gold,

In February 2013, Russia was one of the top holders of U.S. Treasury securities, with $165 billion invested. China was number one at $1.252 trillion. As of June 2018, China is still the top foreign holder of U.S. Treasuries with $1.179 trillion. However, Russia has dumped virtually everything, with only $15 billion in U.S. Treasuries remaining.

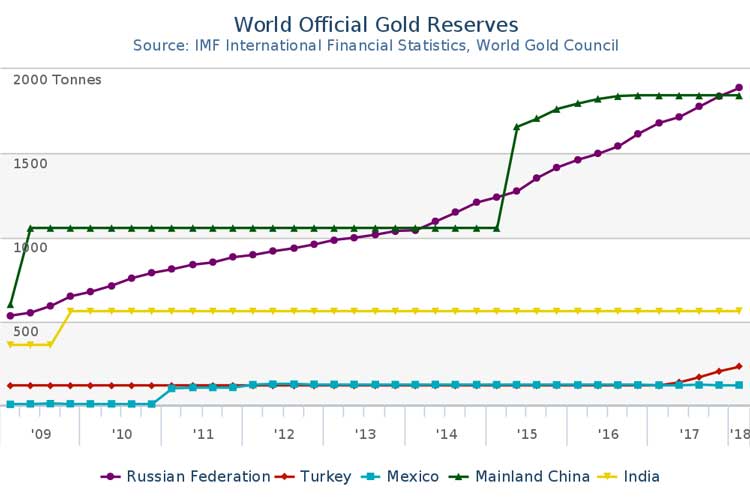

At the same time, both China and Russia have been on a gold buying spree for the last decade. As you can see from the chart below, both countries have almost tripled their gold reserves since 2009.

According to the Q2 2018 Report from the World Gold Council (Gold.org), “Russia’s voracious appetite for gold is strategic – amidst geopolitical tensions, it looks to diversify away from the U.S. dollar.” On May 8, 2018, Russian President Vladamir Putin said that he wants to break away from the dollar to establish “economic sovereignty.” Selling Russia’s U.S. T-bills is only part of that strategy. Putin wants to take the oil trade off of the dollar standard as well. “The whole world sees the dollar monopoly is not reliable; it is dangerous for many, not only for us,” according to Putin.

China is very interested in trading oil with Russia (and others) in yuan instead of U.S. dollars, as well. On March 29, 2018, Reuters reported that China is launching a pilot program to pay for oil in yuan. China is the world’s largest oil importer (and second largest consumer behind the U.S.). China imports most of their oil from Russia, Angola, and Saudi Arabia. The pilot program with Russia, Iran, and Angola could launch anytime now. To make the trade more attractive, China is offering to convert their currency into gold on demand. As the trade war heats up with China, there is also concern about what China will do with their Treasury holdings.

The Grand Total of the foreign T-Bill holdings as of June 2018, is $6.212 trillion. The total U.S. public debt is currently $21.4 trillion. So, who holds the majority of the debt? Actually, it is us (U.S.). If you check your retirement account, you probably hold Treasury bills there. Additionally, $5.7 trillion has been borrowed from the “intragovernmental holdings” such as the Social Security trust, Medicare, Federal Employees, Disability, Unemployment, and others.

So, should you be following Russia’s lead and trading in your T-bills for gold?

If you wish to continue reading more of Natalie Pace’s blog or to access links to the data, click here.

If you wish to continue reading more of Natalie Pace’s blog or to access links to the data, click here.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace’s great, great grandfathers James Pace and Lorenzo Wright were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching, and 3-day Financial Empowerment Retreats.