Contributed Photo/Courtesy U.S. Census Bureau: Young adults are some of the hardest hit by loss of income during the COVID-19 pandemic.

By Brian Mendez-Smith and Mark Klee

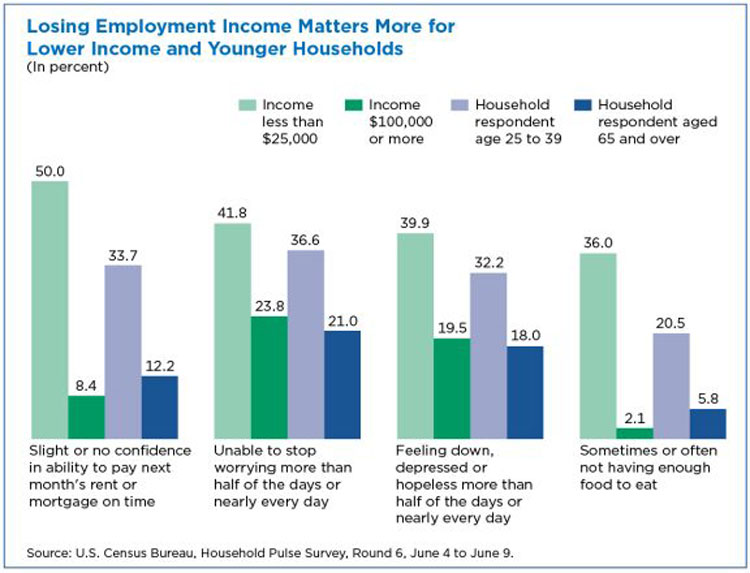

WASHINGTON D.C. – Adults in lower-income and younger households who suffered job losses during the COVID-19 pandemic have less confidence they can pay the next month’s rent or mortgage on time and suffer more mental anguish and food insecurity.

These findings come from an analysis of Household Pulse Survey data released Wednesday, June 17, by the U.S. Census Bureau.

Paying Next Month’s Rent or Mortgage

Among households that experienced lost employment income, half of the adults in households with an income of less than $25,000 had either “no confidence” or “slight confidence” in their ability to pay the next month’s rent or mortgage on time, compared with 8.4% of adults in households with an income of $100,000 or more.

Among respondents ages 25 to 39, 33.7% had either “no confidence” or “slight confidence” in their household’s ability to pay the next month’s rent or mortgage on time, while 12.2% of respondents aged 65 and above felt this way.

Worried, Depressed or Hopeless

Among adults living in households where someone experienced losses in employment income, the rate of adults who reported feeling worried, down, depressed, or hopeless during the past week was higher for younger and lower-income households.

For example, 41.8% of adults in households with an income of less than $25,000 reported an inability to stop worrying “more than half of the days” or “nearly every day” in the past week, compared with 23.8% of adults in households with an income of $100,000 or more.

Among adults ages 25 to 39, 36.6% reported an inability to stop worrying “more than half of the days” or “nearly every day” in the past week, while 21% of adults ages 65 and above reported this same level of worrying.

Adults in households with an income of less than $25,000 reported feeling down, depressed or hopeless “more than half of the days” or “nearly every day” in the past week 39.9% of the time, compared with 19.5% of adults in households with an income of $100,000 or more.

Among adults ages 25 to 39, 32.2% reported feeling down, depressed, or hopeless “more than half of the days” or “nearly every day” in the past week, while 18% of adults ages 65 and above reported that same frequency.

Food Insecurity

Among adults living in households where someone experienced losses in employment income, 36% of adults in households with an income of less than $25,000 reported either “sometimes not having enough to eat” or “often not having enough to eat” in the past week, compared with 2.1% of adults in households with an income of $100,000 or more.

Among adults ages 25 to 39, 20.5% reported “sometimes not having enough to eat” or “often not having enough to eat” in the past week, while 5.8% of adults ages 65 or over reported this same level of food insufficiency.

What Is the Household Pulse Survey?

The Census Bureau along with other government agency partners designed the Household Pulse Survey to collect and disseminate data in near real-time to provide vital insights into how American households are doing during the COVID-19 pandemic.

The first round of data was collected for the April 23 – May 5 period. The most recent round was collected on June 4 – 9. During this most recent round, the Census Bureau sent invitations to 979,236 households across America by email and SMS text message, and 83,302 households responded.

For a closer look at Census Household Pulse Survey data, see the Household Pulse Survey tables and Public Use File (PUF) microdata.

Brian Mendez-Smith and Mark Klee are survey statisticians in the Census Bureau’s Social, Economic, and Housing Statistics Division.