Contributed Article

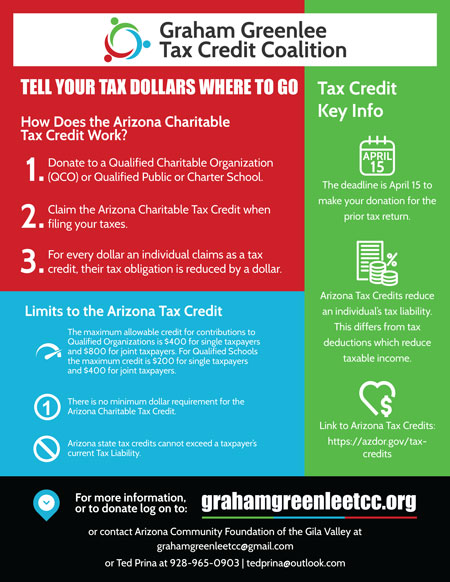

SAFFORD — The Graham Greenlee Tax Credit Coalition is a collaborative of local nonprofits promoting the dollar-for-dollar Arizona income tax credit given to people who donate to qualified organizations that serve low-income individuals in Graham and Greenlee counties. The coalition is comprised of hardworking nonprofits that provide immediate basic needs to local people who have low-income, families or children in need. This year’s members are the Boys and Girls Club of the Gila Valley, Graham County Rehabilitation Center, Graham County Substance Abuse Coalition, Neighbors Farm & Pantry, SEACUS, and Tooth B.U.D.D.S.

You can receive this dollar-for-dollar tax credit on your Arizona state income tax return and keep your dollars local. Your gift goes to work right away in your community, providing support to the eligible organizations and schools of your choice. Donations made now through April 15 qualify for a dollar-for-dollar tax credit on taxes owed in 2021 Arizona state income tax returns. For more information about the coalition, please visit our website at grahamgreenleetcc.org or the Facebook page at www.facebook.com/grahamgreenleetcc.

The Graham Greenlee Tax Credit Coalition is grateful to many local businesses and organizations for their generous support including United Way of Graham & Greenlee Counties, Vining Funeral Home, AshCreek Financial, Luke and Teonna Hoopes with Edward Jones, Smith and Taylor Automotive, Farmers Insurance, Farm Bureau Insurance, CMI Quick Copy, the city of Safford, the town of Thatcher, both the Graham and Greenlee Chambers of Commerce, Safford, Thatcher, and Pima Unified School Districts, and more.

The Arizona Community Foundation of the Gila Valley is proud to serve as the fiscal agent and organizer of this project and tax credit coalition representative, Ted F. Prina, can be reached at 928-965-0903 for questions or comments.