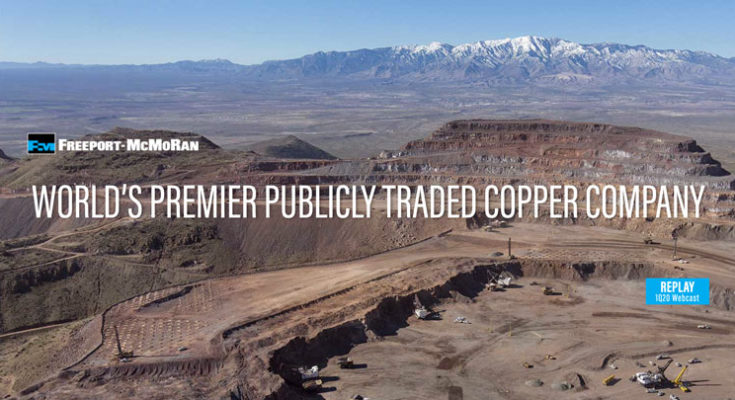

Freeport McMoRan Image: Aerial view of the Lone Star copper leach project adjacent to its Safford Mine.

Milling rates in North America to be reduced by 20 percent

Lone Star copper leach project initial phase to be completed

By Jon Johnson

PHOENIX – Mining giant Freeport-McMoRan announced its revised operating plans Friday and while it plans on reducing milling at its seven mines in North America by 20 percent, it will complete the Lone Star copper leach project adjacent to its current Safford Mine.

For the entire company, it expects a $1.3 billion reduction in operating costs for 2020, with an $800 million reduction in capital expenditures.

The company plans to target a lower-cost mining configuration in North America, defer all nonessential projects and preserve long-term value in its long-lived resources, according to the release. Freeport said the 20 percent reduction in milling will result in a 12 percent projected decline in North America coper sales for the year, lower unit net cash costs and lower capital spending requirements.

Lone Star

Plans are to complete the initial phase of the Lone Star leach project adjacent to its fully owned Safford Mine.

The project is already approximately 90 percent complete and has a remaining investment of about $100 million in 2020. Freeport expects a quick return on its remaining investment and believes in the long-term value of the asset. Production is expected during the second half of 2020 and is expected to eventually average roughly 200 million pounds of copper per year along with the potential of future expansion options.

On April 15, Senior Vice President and Chief Administrative Officer Steve Higgins sent an email to North American workers advising of a hiring freeze and the rescinding to all job offers and the suspension of the company’s summer intern program. Higgins advised the company would also announce furloughs at its operating sites in the coming weeks and encouraged those who could to take advantage of an “enhanced separation program” that involves severance benefits to those who wish to leave the company. Freeport is also looking into if there is any interest in part-time employment and unpaid leaves of absences for up to one year.

“At all levels of the company, we will all be required to make sacrifices during this unprecedented time,” Higgins wrote in his letter. “We have already begun implementing several cost-savings initiatives to align our support with the adjusted operating plans and reduce spending in the face of what could be a prolonged market downturn.”

Morenci Operations

Freeport-McMoRan Vice President of Communications Linda Hayes said Friday evening that the Morenci Mine will reduce its output and its workforce in the coming weeks.

“Morenci will be reducing mining and milling rates and implementing a new organizational structure during the next few weeks,” Hayes said. “The reorganization will include the elimination of some positions and a small number of furloughs.”

Morenci Operations Vice President Mike Kridel sent an email to Morenci Operations employees and advised that the mill would be placed on a care and maintenance status as contractors are replaced by Freeport employees. Company employees should see the change to replace contractors in the next few weeks while some positions will be entirely eliminated and other employees will be furloughed.

“We are also actively looking to replace contractors with Freeport-McMoRan employees to minimize the impact on our workforce,” he wrote in his email.

Freeport is the largest employer in Greenlee County and operates seven open-pit copper mines in North America. It owns a 72 percent interest in the Morenci Mine, which is its largest mine in North America. It also operates its wholly-owned Safford Mine and began its Lone Star copper leach project near the Safford Mine in 2018. Production at Lone Star is expected to average approximately 200 million pounds of copper per year to start. A large number of workers and businesses in Graham and Greenlee counties are directly tied to the mines.

While letters from Safford Operations General Manager Jeff Monterith and Tyrone, New Mexico Operations General Manager Erich Bower advise no significant changes will be seen at those two places, the same cannot be said for the Chino, New Mexico mine, which was closed April 11 after an outbreak of COVID-19 among employees.

According to the Silver City Daily Press, a joint letter written by Bower and Chino Operations General Manager Chad Fretz advised that most employees at the Chino Mine will be placed on furlough for up to 30 days beginning Sunday.

“While there remains some uncertainty on the total impact to our workforce, it is clear we will be required to lay off a large number of employees,” said Fretz and Bower in the letter. “Those impacted could include employees on an unpaid furlough and/or those who remain working during this time.”

Prioritizing Health and Safety

The release states Freeport has implemented protocols at each of its operating sites to contain and mitigate the risk of the spread of COVID-19. Those protocols include physical distancing, travel restrictions, sanitizing, and frequent health screening and monitoring.

Freeport shut down its Chino Mine in New Mexico earlier this month after a number of employees tested positive for the virus. The release states the mining company has been effective at mitigating and preventing a major outbreak at its operating sites.

“Our global team is demonstrating an effective response to protect the health of our workforce, provide for business continuity, and support our communities during this unprecedented challenge,” President and Chief Executive Officer Richard C. Adkerson said. “The prudent steps we are taking to safeguard our business, address costs and spending, and preserve our strong liquidity position are necessary to protect long-term asset values in the current weak and uncertain economic environment and to position us to ramp up and resume normal operations safely and quickly as health and economic conditions improve. Our team has substantial experience in successfully executing under volatile market conditions. I am confident that we will overcome the current challenges and ‘prove our mettle’ as we have effectively done in previous periods of economic weakness. We continue to achieve important progress in establishing large-scale, low-cost copper and gold production from our underground ore bodies at Grasberg and advance initiatives in the Americas to position FCX for significant increases in cash flows in 2021 and beyond.”