Editors note: This is a new feature where our readers can submit their investing or economic questions to author and investment guru Natalie Pace.

Dear Natalie: I just graduated from college. My college loan debt is $500/month. I can’t get a job in my career choice (graphic design). So, I’ve begun driving for a ride-sharing service with a leased car. This is so far from my dreams, and I feel stuck in a dead-end job that isn’t even paying me minimum wage when I add up all of my costs. Help!

Dear Stuck in a Dead-End:

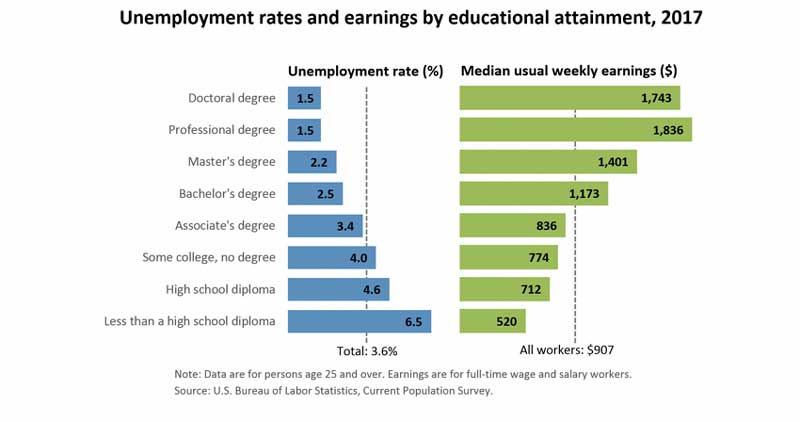

Today’s world is tough for your generation. Housing costs, student loan debt, transportation, health insurance and other basic needs have soared so high that in some markets, like San Francisco, Los Angeles, Seattle, Denver and New York City, you really can’t make ends meet. While it might scare you to think of more student loan debt, at this point, it might be a good idea to see if a professional degree would make sense for you. As you can see from the chart below, you’re more likely to get a job and earn a living wage in the U.S. if you have an advanced degree. Other solutions might include looking at cities where affordability is more reasonable. While interning feels expensive, oftentimes interning can lead to a job.

With regard to your “gig” as a ride-share driver, the statistics on that are not good. Research shows that most drivers are making about $3.00/hour. If you have leased your car, you need to look at the fine print to be sure that you won’t have a giant bill for going over the miles limit when you turn the car back in.

Finally, there are some careers that forgive your student loan debt, up to certain limitations and qualifications. You might consider looking into volunteer organizations, like the Peace Corps, Americorps, federal agencies, teaching positions and public service.

This is a tough time for you. However, if you allow yourself to get comfortable in a dead-end job, then you’re going to have an even tougher time jumpstarting new opportunities in the future. So, I encourage you to do some serious soul-searching, and to reach outside your current vision and comfort zone, to see what might be possible. When Joe Moglia, the chairman of TD AMERITRADE, was in your position, he went back to school and adopted a very modest lifestyle in order to jumpstart a new career path in financial services. That choice was very difficult at the time but has paid off in spades for him and his family.

I’ve designed a game, called The Billionaire Game, to help with that. You can find more details about the Billionaire Game in my book, The Gratitude Game.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace’s great, great grandfathers James Pace and Lorenzo Wright were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching and 3-day ABCs of Money Retreats.