Prop firm trading in 2025 is no longer about simply predicting direction. Evaluation models have tightened, drawdown rules are enforced algorithmically, and even profitable strategies fail when trade management is inefficient.

In this environment, a partial close EA has become one of the most practical tools for traders who need to balance profit extraction with strict risk limitations.

Unlike full-exit systems that force traders to choose between staying in or getting out, partial closing allows positions to evolve in stages. This layered exit logic is particularly aligned with prop firm rules, where locking profits early can be the difference between passing and failing a challenge.

This article focuses specifically on how partial close works in professional trading, why it matters for funded accounts, and which MetaTrader tools currently offer the most reliable implementations of this mechanism.

Why Partial Close Matters More Under Prop Firm Rules

Prop firms do not reward aggressive exposure. They reward consistency, controlled risk, and capital preservation. Maximum daily loss, overall drawdown, and equity-based limits make it dangerous to let a full position fluctuate freely after it becomes profitable.

A Partial close EA addresses this problem by reducing exposure progressively instead of abruptly. When the price reaches predefined levels, a portion of the position is closed, converting floating profit into realized balance while the remaining volume continues to trade.

This creates three measurable advantages:

- Equity stabilization: Realized profits reduce equity volatility.

- Drawdown protection: Smaller remaining volume lowers risk during pullbacks;

- Rule compliance: Locked-in gains provide a buffer against sudden reversals.

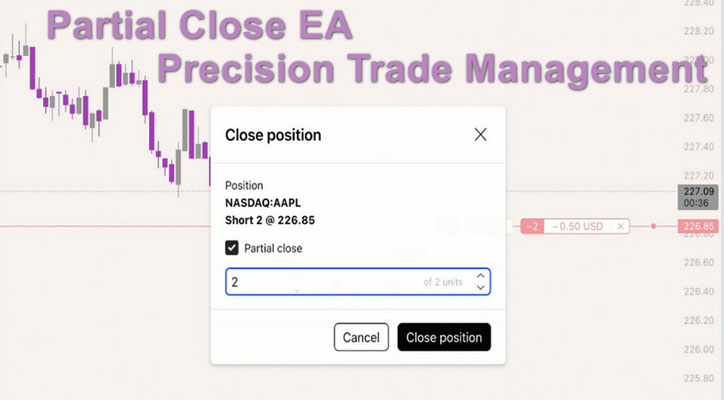

How Partial Close Works at the Order Level

At a technical level, partial close modifies the original order volume rather than creating new trades. For example:

- Initial position: 1.00 lot BUY on EUR/USD

- Price reaches first target: EA closes 0.40 lots

- Remaining position: 0.60 lots continue running

More advanced EAs allow multiple partial exits (TP1, TP2, TP3), percentage-based closures, monetary-based closures, and dynamic triggers linked to trailing logic or indicators.

A well-designed Partial close EA ensures that these reductions happen automatically, without manual intervention, slippage-sensitive delays, or emotional decision-making.

Manual Partial Closing vs Automated Execution

While MetaTrader allows manual partial closing, relying on it during live prop firm trading introduces several problems, including reaction delays during high volatility, inconsistent execution across trades, and emotional bias when deciding how much to close, among others.

Automation removes these weaknesses. A Partial close EA executes based on predefined logic, not market noise or trader hesitation. This consistency is especially valuable during evaluations, where one unmanaged trade can invalidate weeks of disciplined trading.

What to Look for in a Partial Close EA

Not all implementations are equal. Prop firm traders should evaluate partial close tools based on several factors, such as compatibility with drawdown logic (daily, weekly, total), multi-symbol handling, precision in lot reduction, etc.

The best Partial Close EAs available

Below are three MetaTrader tools that meet these criteria to varying degrees. Find out which one is suitable for your needs:

Prop Firm Capital Protection Expert

The Prop Firm Capital Protection Expert by TradingFinder is built specifically for funded account environments. Unlike strategy EAs, it does not generate entries. Instead, it acts as a trade control layer, enforcing capital protection rules across all open positions.

Partial close in this EA is not isolated; it operates alongside break-even, trailing stop, equity limits, and profit caps. This creates a coordinated system rather than a single-function tool.

Practical Capabilities

- Step-based partial closing to secure profit in stages

- Equity-aware logic that adapts to account limits

- Multi-symbol control from a single professional panel

- Automatic trading suspension after loss thresholds

- Seven configuration tabs for fine-grained control

- Built-in news filters to avoid volatility traps

For traders who must follow prop firm rules precisely, this is the most comprehensive Partial close EA framework currently available.

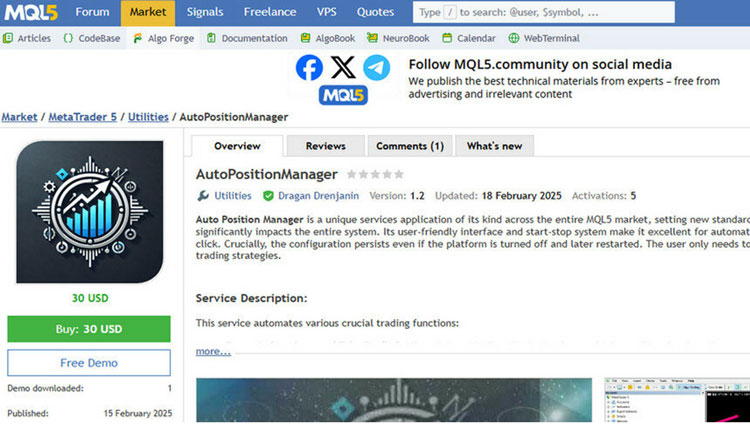

AutoPositionManager

AutoPositionManager, developed by Dragan Drenjanin, was released on February 15, 2025, and is priced at $30. This service application introduces dynamic stop loss and take profit adjustments, along with monetary and percentage-based trade management.

Key Characteristics

- Partial closing based on percentage or currency value

- Dynamic stop loss and take profit adjustments

- Persistent operation even after platform restarts

- Simple activation and deactivation controls

- Suitable for traders managing multiple manual entries

This solution works best for traders who prefer hands-on entries but want automated exits governed by strict logic.

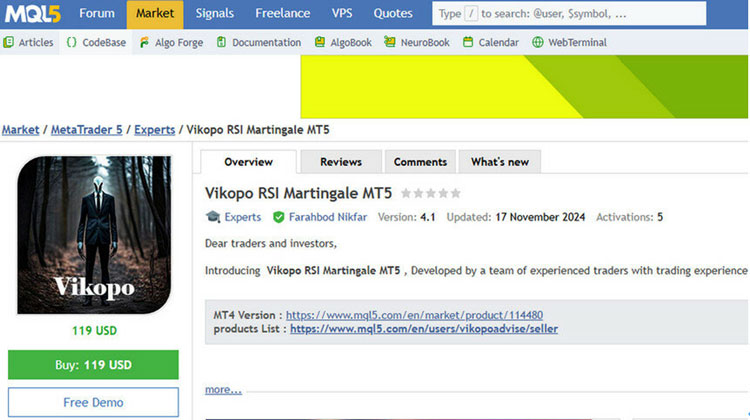

Vikopo RSI MT5

Vikopo RSI MT5 is a fully automated trading system rather than a pure management tool. Developed by Farahbod Nikfar, it combines RSI-based entries with AI-enhanced logic.

Although trading signals are central to the system, capital protection features, including partial close, are integrated directly into trade execution.

Partial Close Integration:

- Automatic partial exits during trend continuation

- Break-even and trailing stop coordination

- Optimized primarily for XAUUSD and major pairs

- Compatible with ECN and raw spread environments

- Requires a minimum operational balance

For traders looking for an all-in-one system that includes partial close without external tools, this EA provides that structure.

Final Thoughts

Partial close is no longer an advanced feature; it is a baseline requirement for professional prop firm trading. A well-implemented Partial close EA transforms random profit-taking into a structured, rule-driven process that aligns with modern funded account constraints.

However, each EA discussed serves a distinct purpose, and the optimal choice depends on strategy structure, risk tolerance, and trading workflow.

In a market where survival matters as much as profitability, partial close is not about squeezing extra pips; it is about staying funded.

FAQ

What is a Partial Close EA, and how does it work?

A Partial Close EA automatically closes a portion of an open trade at predefined levels, locking in profit while keeping the remaining position active.

Why is partial closing important for prop firm traders?

Because strict drawdown and equity rules reward consistency, partial closing helps stabilize equity and reduce risk after a trade becomes profitable.

Is an automated Partial Close EA better than manual partial closing?

Yes. Automation removes emotional bias, execution delays, and inconsistency, which are common causes of rule violations in prop firm evaluations.

Can a Partial Close EA work alongside break-even and trailing stops?

High-quality EAs integrate partial close with break-even, trailing stops, and equity limits to create a coordinated risk management system.

Does a Partial Close EA place new trades on my account?

No. Most Partial Close EAs do not generate entries; they only manage existing trades by reducing position size based on predefined rules.