This and other important takeaways from Federal Reserve Chairman Jerome Powell’s speech Aug. 24 at Jackson Hole, Wyoming and the FOMC minutes of the Aug. 1 meeting.

The Fed Funds futures contracts put the odds of a Fed Funds rate increase at the September 26, 2018 meeting at 90%. If Federal Reserve Chairman Jerome Powell raises rates, as is expected, this will be in direct opposition to the Tweets of the President. So should interest rates rise, or is this slaying the 10-year old bull market before its time?

There are many takeaways from Federal Reserve Chairman Jerome Powell’s speech Aug. 24 at Jackson Hole, Wyoming and the FOMC minutes of the Aug. 1 meeting that explain why the Feds are raising the Fed Fund rate at this time. For additional information on the Feds’ case for raising interest rates, refer to my blog, “The Federal Reserve vs. The White House.”

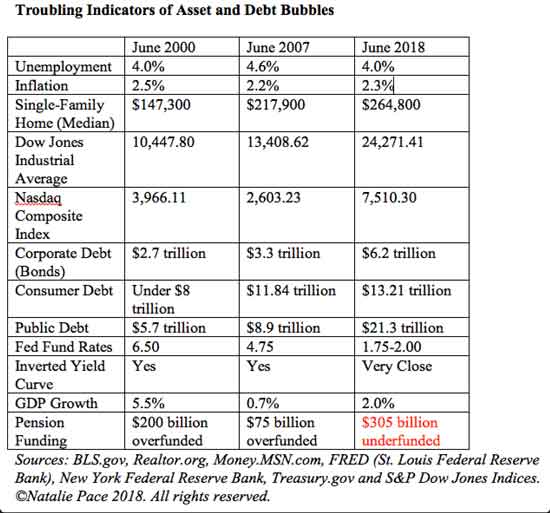

In his speech at Jackson Hole, Federal Reserve Board Chairman Jerome Powell explained, “In the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation. Thus, risk management suggests looking beyond inflation for signs of excesses.” This is easily seen in the chart below.

Before the Dot Com Recession and the Great Recession, unemployment was historically low (below 5%) and inflation was also low (at 2.5% or below). However, there was a lot of free, easy money flowing into asset bubbles. Low-interest rates create bubbles. In 2000, it was the Dot Com Bubble. In 2008, it was the housing bubble. Today the asset bubbles in stocks, bonds, and real estate are more troublesome than they were in 2000 or 2008, and debt has become absolutely astronomical. This has been something the Feds have been concerned about for at least two years. At a special meeting of the Federal Advisory Council and the Board of Governors on Sept. 7, 2016, it was recorded that “If rate normalization happens in a steady and more predictable approach, the economy can incorporate this change in rates and psychology and make investment decisions based on the best allocation of capital to productive sources versus riding the asset bubble being generated by the easy-money policies around the globe.”

Before the Dot Com Recession and the Great Recession, unemployment was historically low (below 5%) and inflation was also low (at 2.5% or below). However, there was a lot of free, easy money flowing into asset bubbles. Low-interest rates create bubbles. In 2000, it was the Dot Com Bubble. In 2008, it was the housing bubble. Today the asset bubbles in stocks, bonds, and real estate are more troublesome than they were in 2000 or 2008, and debt has become absolutely astronomical. This has been something the Feds have been concerned about for at least two years. At a special meeting of the Federal Advisory Council and the Board of Governors on Sept. 7, 2016, it was recorded that “If rate normalization happens in a steady and more predictable approach, the economy can incorporate this change in rates and psychology and make investment decisions based on the best allocation of capital to productive sources versus riding the asset bubble being generated by the easy-money policies around the globe.”

Rate hikes have caused market volatility (on the downside) this year, so it is likely that September 26, 2018 will be an active day – or before, if the “smart money” starts its move early. Will this kill a Santa Rally? Or will it just be a temporary blip? One could make a case either way.

However, the 10th year of a bull market is a very good time to get defensive and make sure that you have enough safe and know what is safe in a world where both stocks and bonds are in a bubble (according to Alan Greenspan, Warren Buffett, Robert Shiller and multiple economists). It’s never a good idea to go all or nothing or try market timing. My easy-as-a-pie-chart nest egg strategies work great, having earned gains in the last two recessions and outperforming the bull markets in between. Call 310-430-2397 to learn more about these time-proven strategies.

If you wish to continue reading more of this Natalie Pace blog and see a few more takeaways from the Aug. 1 Federal Open Market Committee meeting and Jerome Powell’s speech of Aug. 24. click here.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for more than three years (in its vertical). Natalie Pace’s great, great grandfathers James Pace and Lorenzo Wright were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching, and 3-day Financial Empowerment Retreats.