Ever since crypto market frontrunner Bitcoin generated a new financial and technological revolution over 17 years ago, the crypto space has continued to evolve and become increasingly sophisticated. Interoperability and communication between networks have become vital for any protocol seeking to achieve meaningful adoption in today’s world, which is increasingly populated with hundreds of digital ledgers.

The earlier blockchain architectures were self-contained and wouldn’t permit communication between blockchains – each blockchain worked in isolation. Ethereum, which currently holds the largest market share among all blockchains, cannot interact with Bitcoin, the blockchain tied to the first and largest cryptocurrency ever. Polygon – Ethereum’s scalability partner that processes transactions faster and at a lower cost before settling them on Ethereum for security – was unable to interact with Solana, a high-speed blockchain known for transaction fees that often fall below $0.01. Do you see the problem? These networks held immense potential individually, yet couldn’t speak the same language, despite existing in the same digital universe.

And as more blockchains emerge, each with its own architecture, token economy, and community, one of the biggest existing challenges is upgrading them to communicate with each other. That’s where interoperability comes in. It’s not just a technical ambition anymore but a foundational requirement for the future of crypto to thrive across ecosystems.

While many newcomers to crypto start their journeys by learning how to buy Bitcoin, they quickly come to learn that there’s a much broader ecosystem right there, with data, apps, and tokens. Understanding the role of interoperability in the crypto landscape provides a clearer picture of where the crypto and blockchain industries are headed and why the next evolutionary phase is about moving digital assets freely and securely across an increasingly interconnected blockchain web.

Understanding interoperability and the crypto multichain future

The steady emergence of multiple blockchains has created fragmentation across the sector, and without cross-chain protocols, smart contracts and assets remain isolated. Interoperability has turned into an operational necessity in a world where decentralized finance (DeFi) holds over $80BN in liquidity and continues growing, leaving users expecting to engage with protocols across Ethereum, Solana, Avalanche, and so on. The solution? An infrastructure that’s capable of connecting all these ecosystems at the protocol level.

Bridges and messaging protocols

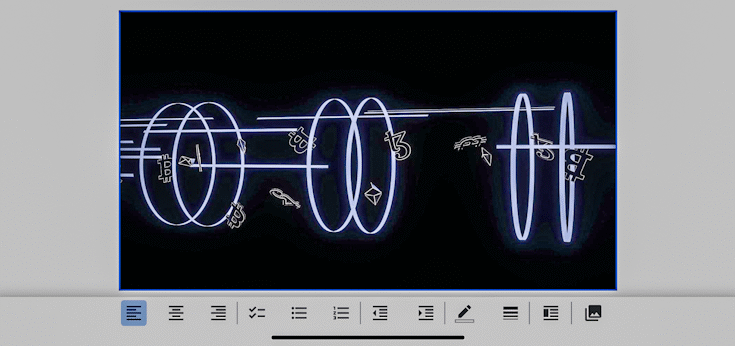

To turn that infrastructure into reality, the ecosystem depends on interoperability solutions and bridges, like LayerZero, Axelar, Hyperbridge, and Wormhole, all of which allow smart contracts to communicate seamlessly across multiple blockchains. In plain English, they enable smart contracts on, say, Ethereum, to interact with liquidity, votes, and assets on Polkadot. Interoperability at first focused primarily on things like decentralized governance, token transfers, and cross-chain composability. Bridging the gap between protocols now resembles an arena of UX, security, and features.

There’s fierce competition for trust in this area, with examples like Lido DAO’s preference for Wormhole over LayerZero serving as proof.

How an ideal bridge should be

Users look for lightning-fast speed, negligible costs, and failproof security when transferring assets from one chain to another. However, it’s challenging to achieve them all simultaneously, for different protocols use different mechanisms. For instance, the burn-and-mint model means that tokens are locked on one chain while equivalent tokens are created on another. And here’s where the trust-minimized solutions step in.

Trust-minimized systems are designed to rely as little as possible on trusted third parties or intermediaries. They use decentralized consensus, cryptographic proofs, and transparent protocols to guarantee fairness and security automatically instead of assigning this task to go-betweens like banks or governments. If you no longer want to be forced to blindly trust an entity to manage your data and transactions, this system might work for you. It reduces risks like hacks, fraud, or censorship – all of which are probabilities when central points of control exist.

Sui sees momentous new launches

One of the latest milestones in interoperability is the latest launches on the Sui network. Sui-based IKA crypto, for instance, was launched on the 29th of July and has managed to gain +20% in just 24 hours, landing at $0.036. This release is a peerless achievement for the network thanks to its cross-chain capabilities that extend Sui’s influence across the crypto ecosystem, allowing smooth interaction with assets on other ledgers.

As per the words of Omer Sadika, Ika’s co-founder, the mainnet’s introduction on July 29 celebrates the beginning of a “new era in blockchain interoperability”. It’s a model shift that’s generating unmatched opportunities for institutions, developers, and retail users, all on the back of Zero-Trust interoperability.

A few prominent blockchain projects have already started using the new feature, highlighting the protocol’s strength and flexibility.

What interoperability means for devs and users

It’s only normal to wonder why there’s so much noise around interoperability. This capacity translates to access without barriers, enabling the movement of governance votes and assets between networks and the use of DeFi without being limited to a single blockchain.

For developers, all these bring about unified data layers and cross-platform liquidity, making for a more efficient and inclusive blockchain ecosystem. As an example, they can enjoy better prices and tighter spreads when liquidity sweeps across chains (platforms). Additionally, they can develop apps such as lending platforms and DEXs that benefit from increased capital, which enhances the functionality and appeal of their platforms.

Challenges and stumbling blocks

Despite the potential that can be unlocked, interoperability is not child’s play. Users have different, often opposing priorities: some want lower fees, others prioritize finality speed, and others seek the best possible security. Regulatory frameworks are still evolving to keep pace with trends, particularly where assets intersect with national or legal restrictions.

The outlook for the future

Interoperability has evolved from an operational nice-to-have feat to a structural necessity. With the continuous multiplication of chains, the inability to communicate with one another becomes the main stumbling block to adoption. Emerging technologies like trust-minimized models, XKP-based messaging, and universal indexing APIs are becoming the norm in the multichain landscape.