Helping out a family member in a different country is something that many of us have to do, but getting the money moved from A to B quickly can prove difficult. If they need urgent financial help for medical bills, accommodation, or travel arrangements, or you want to send a gift, the last thing you want to be faced with is a series of complex admin tasks.

To make sure you know exactly what you need to do, we’ve created a simple step-by-step guide that will take you through all of the key steps involved. Work through it in a couple of minutes, and you’ll be able to help your loved one without delay.

Check their personal details

You will need their full name and address to be able to send money internationally, and the latter may not be something you know by heart. Getting them to put everything in writing, either in a WhatsApp message or email, will ensure that you always enter the correct details. And for the avoidance of doubt, don’t be afraid of slowing things down slightly by checking you have the address right. Overseas addresses are often formatted in ways many of us are unfamiliar with, so a quick double check will be worth it.

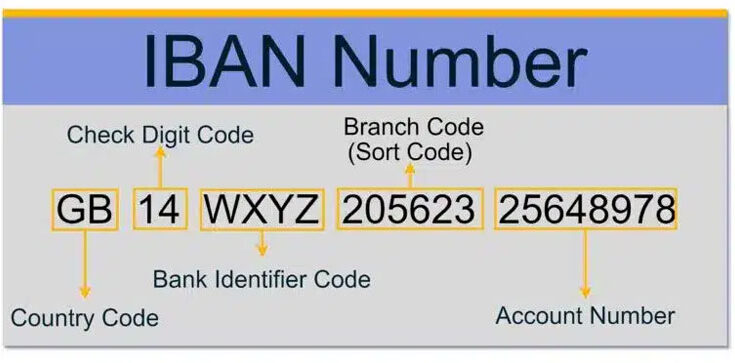

Get their IBAN and check it

Domestic bank transfers require the account number, but international transfers can require an IBAN. This is essentially just the global version of their account number and includes a series of extensions that ensure the number is unique from every other account in the world. The IBAN is used by money transfer services and banks to make sure that they are sending the money to the right account. Without it, the money cannot be sent, and the transfer will remain incomplete.

Find the SWIFT code

The SWIFT code is the second piece of the puzzle, and you can think of it as the recipient’s international bank address. Any money that you send is not moved from one account to another on its own — banks need to move the money off their books and onto the books of another bank. In many cases, there will be several intermediary banks that move the money across international borders. Online guides by money transfer specialists will guide you through what is a SWIFT code, where to find it, and how to use it. Combined with the IBAN, the SWIFT code forms the global address for the recipient’s account.

Clarify the amount and currency

Double-check the precise amount of money that your loved one needs and the currency they are talking about to avoid having to make a second balancing transfer. If you have a relative who has been abroad for many years, you may find that they naturally talk in their local currency, assuming that you will know they are doing so. Unless they explicitly state the amount and the currency, ask them to clarify both. If nothing else, it will give you the peace of mind that you’re giving them exactly what they need. When you send money, you also need to make sure you’re checking how much the recipient will receive, as it changes every single day.

Find a trusted provider

Local banks are great at what they do, but the problem is that they don’t do all that many international money transfers. Loans, credit cards, and direct debits are more their thing, which means using a specialist service is the best way to go about things. International money transfer services will be able to make sure that your money arrives quickly and efficiently so that your loved one can get the financial help and support they need.

Clarify the fees and rates

Because money transfer services are businesses, it is natural for them to charge a small fee for using their services. Using comparison sites could help you to find a service provider who offers the most competitive fees and charges. At the same time, it’s also important to clarify the exchange rates that they offer, especially when you are transferring large amounts of money on a frequent basis. Once you find a service you trust, ask your point of contact to break down their fee structure so that you can check that you are happy with everything.

Conclusion

Making sure that you work through these key points will save you time and effort before you know it, and it may only take a few minutes. The good thing about this type of structured approach is that it will ensure nothing is overlooked while also helping you to manage the stress of doing something you may find daunting. If in doubt, connect with a trusted international money transfer service and allow them to guide you through the process.