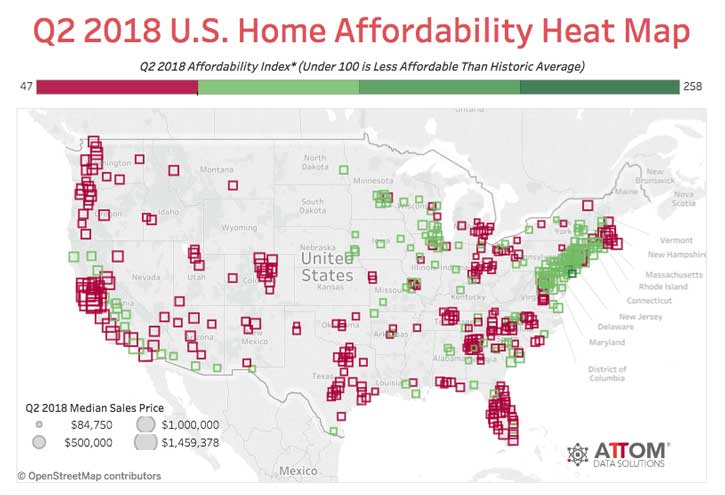

Photo by Sean Russell from Knoxville, TN, Wiki Commons. Used with permission.: The Country Music Hall of Fame and Museum in Nashville, Tennessee. Nashville has become one of the most unaffordable cities to buy a home in (source: AttomData).

Affecting Detroit, Austin, Denver, and Nashville, alongside NYC, San Francisco, Seattle, Los Angeles, Miami (and more).

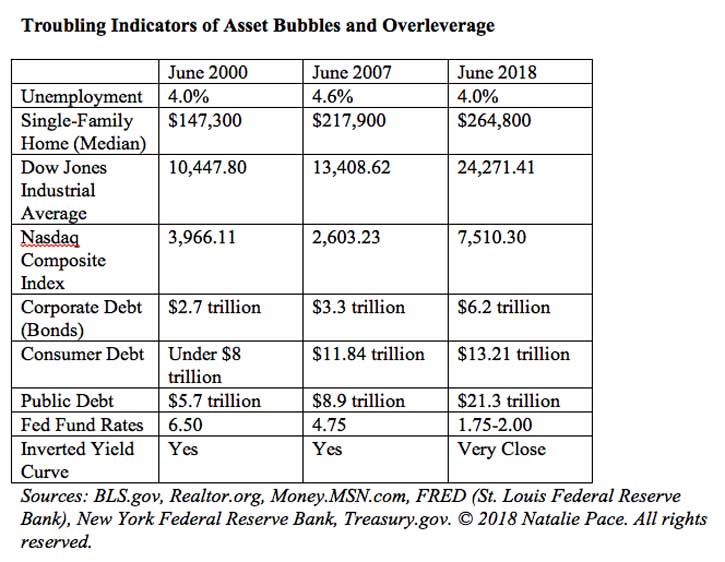

Real estate prices are higher than ever – much higher than they were when the real estate bubble popped in 2007 (on a nationwide media average). The same holds true for stocks, bonds, public debt, consumer debt and more.

And yet, even with the highest prices in history, 5.2 million homes are still seriously underwater on their mortgage.

Rising interest rates and unaffordability make the buying pool smaller. That is a major contributor to home sales falling three months in a row from April through June 2018.

So, should you buy a home now while interest rates are low, even though you are buying high? Should you sell high? Where will you move if you sell now? What should professionals with a good income who are renting and getting killed in taxes do?

11-Point Check List for Homeowners, Home Buyers, and Renters

1. The Mortgage Interest Deduction.

2. Buy What You Can Afford.

3. Have a 10-Year Or Longer Vision.

4. Lock-in a Fixed Interest Rate.

5. Align Your Mortgage Pay-Off Date With Your Retirement Date.

6. If You’re Still Underwater, Get a Second Opinion.

7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years.

8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price.

9. Interested in Buying a Home Abroad? Read my Blog.

10. Consider the Shadow Inventory.

11. Never Buy High.

If you wish to continue reading more of Natalie Pace’s blog or to access links to the data, click here.

Do you have a budgeting, investing or economic questions for Natalie Pace? Simply email info@NataliePace.com.

Natalie Wynne Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace’s great, great grandfathers, James Pace and Lorenzo Wright, were some of the original pioneers of Graham County. Call 310-430-2397 to learn more about Natalie Pace’s books, private, prosperity coaching, and 3-day Financial Empowerment Retreats.